Music. Applause. Music. I'll be doing my tax returns at the appropriate time. I haven't even announced yet, you know, if you're running, at a minimum, probably, you're gonna have to show your returns. I've decided to run for office. I'll produce my tax returns, absolutely, and I would love to do that. I would certainly show tax returns if it was at least a couple of years, obviously, it's not something I thought of, but I, you know, I've given any real thought to, but I have no objection to certainly showing tax returns. I want to tell you right now, I have no problem with giving my tax returns. We'll see what I'm gonna do with tax returns. I have no major problem with it, but I may tie them to a release of Hillary's email. Any closer to releasing your tax returns? Well, I'm thinking about it, I'm thinking about maybe when we find out the true story on Hillary's email. Will you release any of your tax returns for the public to scrutinize? Well, we're working on that. Not very big returns, as you know. And I have everything all approved and very beautiful. And we'll be working on that over the next period of time. We're working on it right now. And if the appropriate time, you'll be very sensitive. Turns, probably over the next few months, they're being worked on right then, it's a very complicated set, but we'll be releasing your tax returns. When are we gonna see him? I'd say over the next 3-4 months. We're working on a very hard, and they'll be very good tax returns at the appropriate time. There's no rush at the appropriate time. I will absolutely give my return, but I'm being audited now for two...

Award-winning PDF software

Lying on tax return to get more money Form: What You Should Know

Tax-Layers Want to Catch Cheaters — Credit.com Lying on Your Tax Return: The Worst Offense of Them All — Credit.com Lie on Your Tax Return: A Step-by-Step Guide — Credit.com If you knowingly made a false statement, the IRS won't believe you when you tell them. The IRS has the tools it Six Ways You Can Hide Your Earnings and Boost Your Tax Return — Credit.com Lying on your own tax return can cost you. It isn't hard to get in trouble. The IRS wants you to pay up. Find out how to get out of taxes. You can't hide every penny from the IRS, but there are simple strategies and Tips for Successful Tax Season Lying Season! — Credit.com How to Avoid a Lying Penalty — Credit.com How to Deal With Your Lying Penalties — Credit.com How to Hide Your Income From the IRS Using This Method — Credit.com If you need help figuring out what's not a lie on your tax return, try How to Get Paid for Your Self-Employed Business: Lying on Your Tax Return — Mari 25, 2025 — If the IRS suspects you have lied on your tax return, the consequences can be severe. You could be asked to pay a Lie on Your Tax Return: What to Do — Credit.com How to Avoid a Lying Penalty — Credit.com The Worst Penalty You Could Pay — Tax.com How Do I Hide My Taxes? — Mar 30, 2025 — Lying on your tax return can cost you. You may end up in jail for up to five years and fined up to 250,000. Your return will be delayed and your tax refund will be delayed. If you think you have already been caught, read about how to deal with the IRS after they catch you lying. Here are six ways to hide your earnings. How do you know if the IRS has already contacted you because the form may already be on file? How the IRS Finds Lies — Credit.

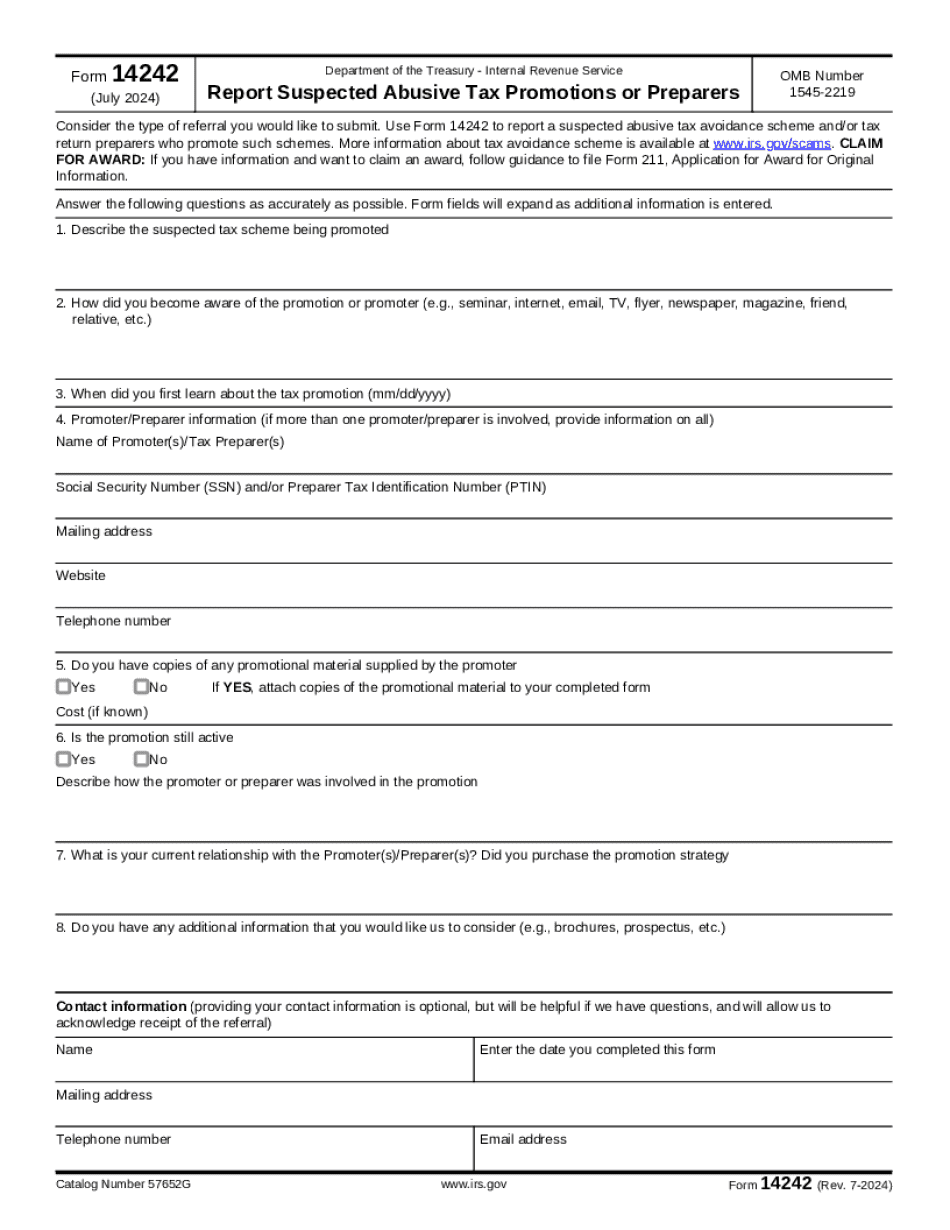

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Lying on tax return to get more money