I'm John Newcomer. We want to give you a brief primer on how to file a False Claims Act case. We're going to give you a checklist of things that you should be gathering that will be helpful to you, helpful to the government, and helpful to the investigation. Here is what you should be doing to prepare: 1. Write down everything you know about the fraud and keep a pad nearby to make notes of additional things as they come to you. What you need to prepare is a written dialogue of everything that took place and everything that you believe is important to establish the false claim. Focus on what action or activity you believed was fraudulent and when that fraudulent activity began and, if it has ended, when did it. It's also very important to know how much money is involved in the fraud, so we need for you to calculate the amount of money that you believe the federal government was defrauded from. Explain how you arrived at that figure. 2. Now, when you're writing things down, make sure you not only include the positive but also include the negatives. We can deal with anything, but we do need to know if there's any negative information out there. Be exact, be detailed, and be as accurate as possible. Don't exaggerate. We need to know exactly what happened. 3. One of the most important things a whistleblower has to understand when they bring a government fraud case is that their case is competing with literally tens of thousands of other cases from all across the United States. The most important thing any law firm specializing in these types of cases can do is to get your case to the top of the pile. Ninety-six percent of all money recovered under...

Award-winning PDF software

Irs whistleblower retaliation Form: What You Should Know

You must identify all sources of information for which you have provided such information for an original information return; Provide a reason for providing the information; Explain why you believe that the information you received was false or misleading; and Provide any applicable evidence of the falsity of such information. Whistleblower Information Source Taxpayer Information Returns: The following information regarding taxpayer information returns and the source of the information provided must be included: the name and Social Security Number of the taxpayer or the individual or persons on whose behalf the return is filed. Taxpayer Identification Number(SIN) if applicable. The information obtained from such an IRS information return may be used as the basis of an investigation or in any other proceeding. You Must Provide Original Information that is not an original information return or other tax information return or return required to be reported to Tax Administration has to be included. If the taxpayer identification number is not correct, the information must be marked as not appropriate for a tax return and should not be received by STAB, the IRS, or any other IRS official. If the information was not provided by you, the taxpayer, or the individual or persons on whose behalf the return is filed, it may not be used or disclosed in any other proceeding. Include Form 211 (whistleblower award claim request) as a part of the original information return. If it does not qualify as an original information return, it must be reported as a separate attachment. If the original information return was not completed at the end of the year, attach all copies. Note: If the Form 211 is not completed and filed, do not file it. If you receive a draft, incomplete form with an identification number missing, you're not required to fill it out before the deadline. If you complete the form in its entirety before the deadline, but the identification number is missing, you must still include a copy of the original or a copy of the correct form. The information you receive must be from documents or information that were provided to you by a source who: If the source provided more than five information returns, you're not required to make sure that the return is submitted as required. If the source provided one or more information returns that were incomplete or incorrect, you must file all information returns that fall within the deadline.

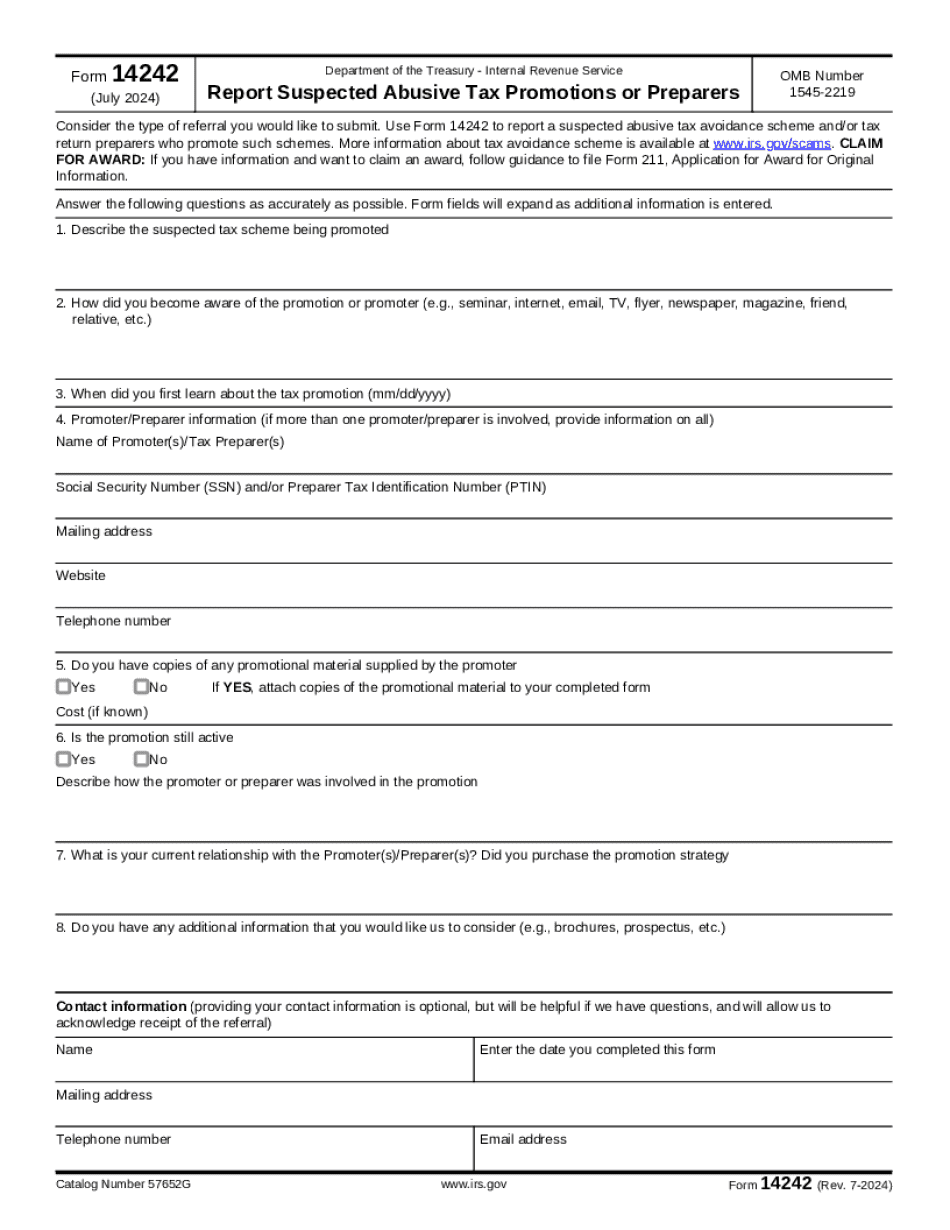

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs whistleblower retaliation