Award-winning PDF software

How to report thots to the irs Form: What You Should Know

Write a report. When submitting your report to the IRS, write “Report of Possible Tax Fraud, Form 3949-A” on the line where it says “Date” “Initiating Action” — meaning, complete all lines of the form and sign and date it to indicate that you completed and signed the form. Use an official pen and not a marker. 5. Wait to hear what the IRS has to say. After you submit your completed form, or after they interview you, the IRS will send you a written notice stating that they have found evidence (and requesting additional information). After you give them the evidence, you should contact the person you want to report. The more information you give them, the better. You can also ask for a tax assessor to review whether the evidence should be accepted or rejected. 6. Ask for a reward. If the IRS claims you should receive a reward for reporting a tax cheat, you can ask the government agency to pay you a reward — for example, if they've found enough evidence to make you certain and believe your claim is more likely than not that the crime was committed and should be punished accordingly. In most cases it's up to the taxpayer to ask for a reward. If you're not sure, ask first. The IRS usually asks for a payment of up to 5,000 in these instances. But depending on your situation, there may be conditions attached to your reward. Find out more about IRS criminal investigations and the IRS Rewards Program in this article published by National Center for IRS Services: What You Need To Know About IRS Rewards Program If you've lost money, the IRS will probably let you claim a loss on any amount in excess of your loss. If, however, the IRS hasn't contacted you that you've lost enough money, you may want to try to sue the government agency. The Small Claims Act provides that if you have a claim for at least 1,000, you may sue your local taxing authority on the ground that a tax is wrongfully taken. See IRS Rev. Stat.

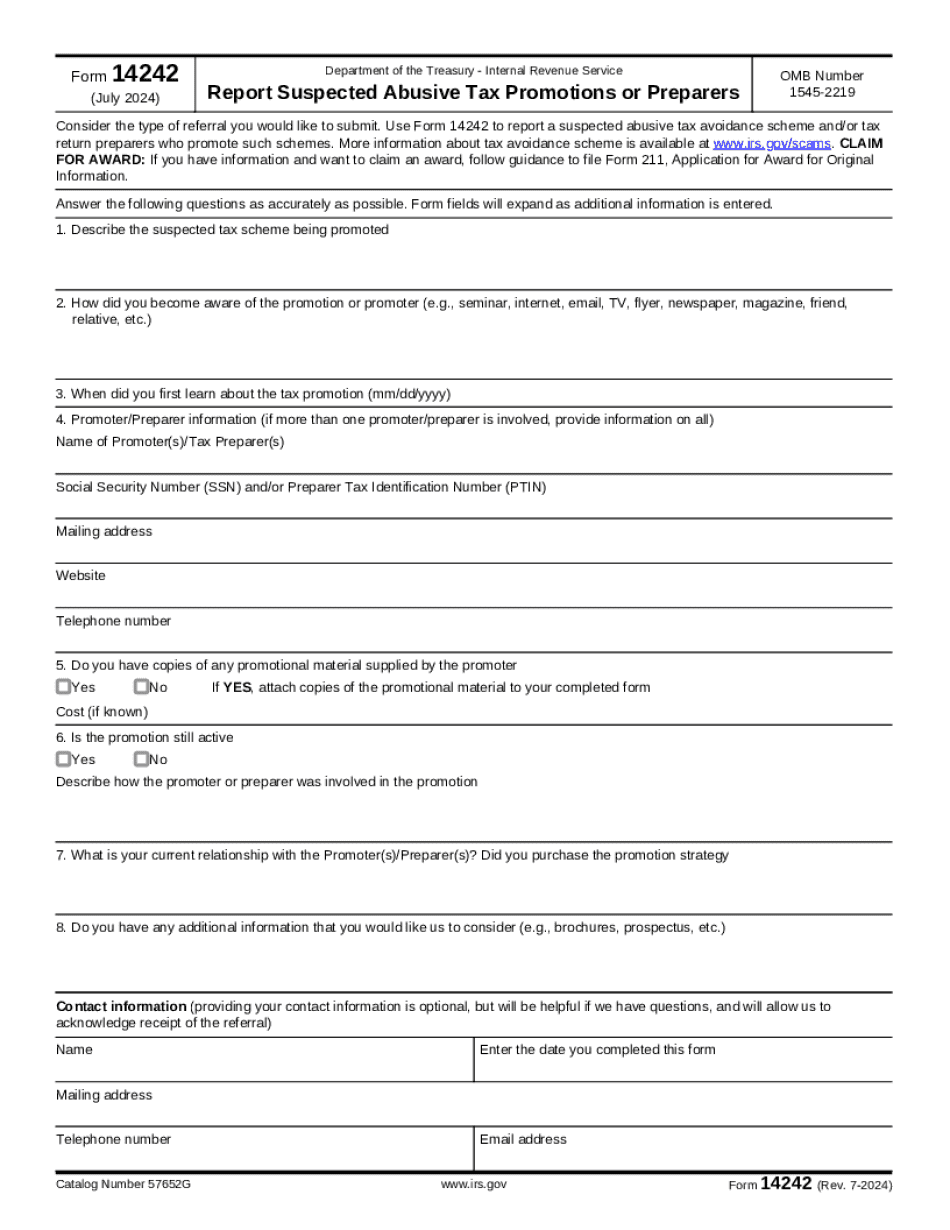

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.