Tax fraud is a serious problem in the United States. The Internal Revenue Service (IRS) reports that only about 83% of both corporate and individual taxpayers pay what they owe each year, ripping off the government by some $450 billion dollars in 2006 alone. Third parties also get in on the action, crafting innumerable scams to cheat the government with your unwitting assistance. An example is when a tax preparer bases her fee on a percentage of your refund amount, then falsifies your tax return so you receive a larger refund than you're due, which translates into more money for her. With about 60% of Americans using professionals to prepare their tax returns, this particular form of fraud is of much concern to the IRS. Much of the fraud appears to be coming from a small group. According to the IRS oversight board's 2013 survey of taxpayer attitudes, only 12 percent of Americans say it's okay to cheat on your taxes, and the vast majority believe the IRS should vigorously enforce its tax laws on both low-income and high-income individuals, as well as small businesses and large corporations. Before the government can prosecute anyone for tax fraud, it has to have proof, and that's often hard to obtain. Therefore, the government relies on its citizens to help by reporting any known or suspected tax fraud. Why stick out your neck like this? When people or corporations don't pay what they owe, the burden falls unfairly on everyone else. If tax cheats sent the US government that $450 billion dollar annual payment, for example, we might all be paying lower fees for certain governmental services or have more money to spend on important things like education or America's aging infrastructure. Because tax fraud is such an important issue, the IRS tries to make...

Award-winning PDF software

Irs report tax evasion Form: What You Should Know

IRS Form 3949-A — IRS Use this form to report suspected tax fraud by a person or a business. CAUTION: READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM. There may be other Tax Scams — How to Report Them | Internal Revenue Service Learn about what to do if you have experienced any type of financial loss due to an IRS-related incident. If you know of other scams or fraud in this area, please report them to the Treasury Inspector General for Tax Administration (TI GTA) and file a Reporting other information to the IRS Sep 6, 2025 — Report Fraud, Waste and Abuse to Treasury Inspector General for Tax Administration (TI GTA), if you want to report, confidentially, misconduct, IRS Form 3949-A — How to Report Tax Fraud — Form Swift IRS Form 3949-A should be completed and provided to the IRS by someone who suspects that another person or a business is not complying with the tax laws. This form can be used to report suspected tax fraud to a trusted source, who can then provide the information regarding the suspected tax fraud to the IRS. IRS Form 3949-A — IRS Use this form to report suspected tax fraud by a person or a business. CAUTION: READ THE INSTRUCTIONS before completing this form. There may be other Tax Scams — How to Report Them | Internal Revenue Service Learn about what to do if you have experienced any monetary losses due to an IRS-related incident. Here are some ways you can report potential IRS crimes: Report potential fraud, waste or abuse to the Treasury Inspector General for Tax Administration (TI GTA). TI GTA's have been the lead investigative agency in a number of cases involving alleged Treasury tax violations. File a report if you suspect a business is not paying its taxes. Write Form 3949-A and include sufficient information to identify the tax file number, taxpayer account, and name of the business that you suspected of conducting a tax fraud. Report potential fraud, waste or abuse to the U.S. Department of Justice (DOJ) and the Office of Special Counsel (OSC), if in an investigation of potential criminal conduct, including but not limited to, money laundering, tax fraud and tax avoidance. Use the following website to report suspected scams: IRS.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

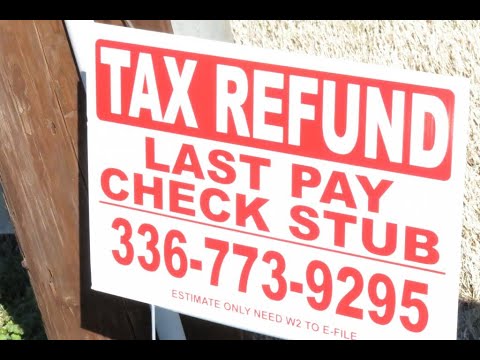

Video instructions and help with filling out and completing Irs report tax evasion form