Award-winning PDF software

Irs whistleblower news Form: What You Should Know

Individuals and their representatives If you are representing a few individuals in connection with a tax problem, and are seeking information about specific IRS procedures for handling claims of retaliation from a particular employee, you may wish to refer to a larger publication by the Government Accountability Office (“GAO”) entitled “Taxpayer First: Whistleblower protection in the federal workforce.” For Information on the Whistleblower Award Program at IRS There is no fee to file a whistleblower application. Information on the whistleblower program is available in the Publication 587-H, The IRS Whistleblower Program, by contacting the Office of Whistleblower Operations at. Get information about the Whistleblower Program, including: Rules and instructions for how to submit a whistleblower application; A list of current program participants that include, by tax year, all employees, directors, or other senior management of the IRS, the Department of the Treasury, and other federal agencies that may receive whistleblower information; How to apply for award, including information on the specific procedures for completing and filing the application and submission of the application to either the IRS or the IG, if applicable for tax years 2012--2018; Information on the IRS Whistleblower Protection Program, including information on how whistleblowers may submit evidence of retaliation under the Inspector General Act and how the IG handles the claim; and Information on additional protections and assistance for whistleblowers. If you are representing a whistleblower, and you are seeking additional information, including a description and description of the information or materials or records that you believe might be relevant to your whistleblower claim, submit the application and additional information to the IRS Whistleblower Office and provide your request to our contact person, the Assistant Chief of Whistleblower Investigations. Please do not send your application, supporting materials and comments, or any other relevant information directly to the Whistleblower Office by email or paper mail. Instead, you may fax the required information to; alternatively, you may send these materials, along with a fax of a completed application and instructions to the Whistleblower Office. How To File a Claim Under — IRS There is no fee to file a claim. The Whistleblower Information Service provides a free, 24-hour hotline that allows you to have a confidential conversation anonymously or without fear of reprisal about tax issues.

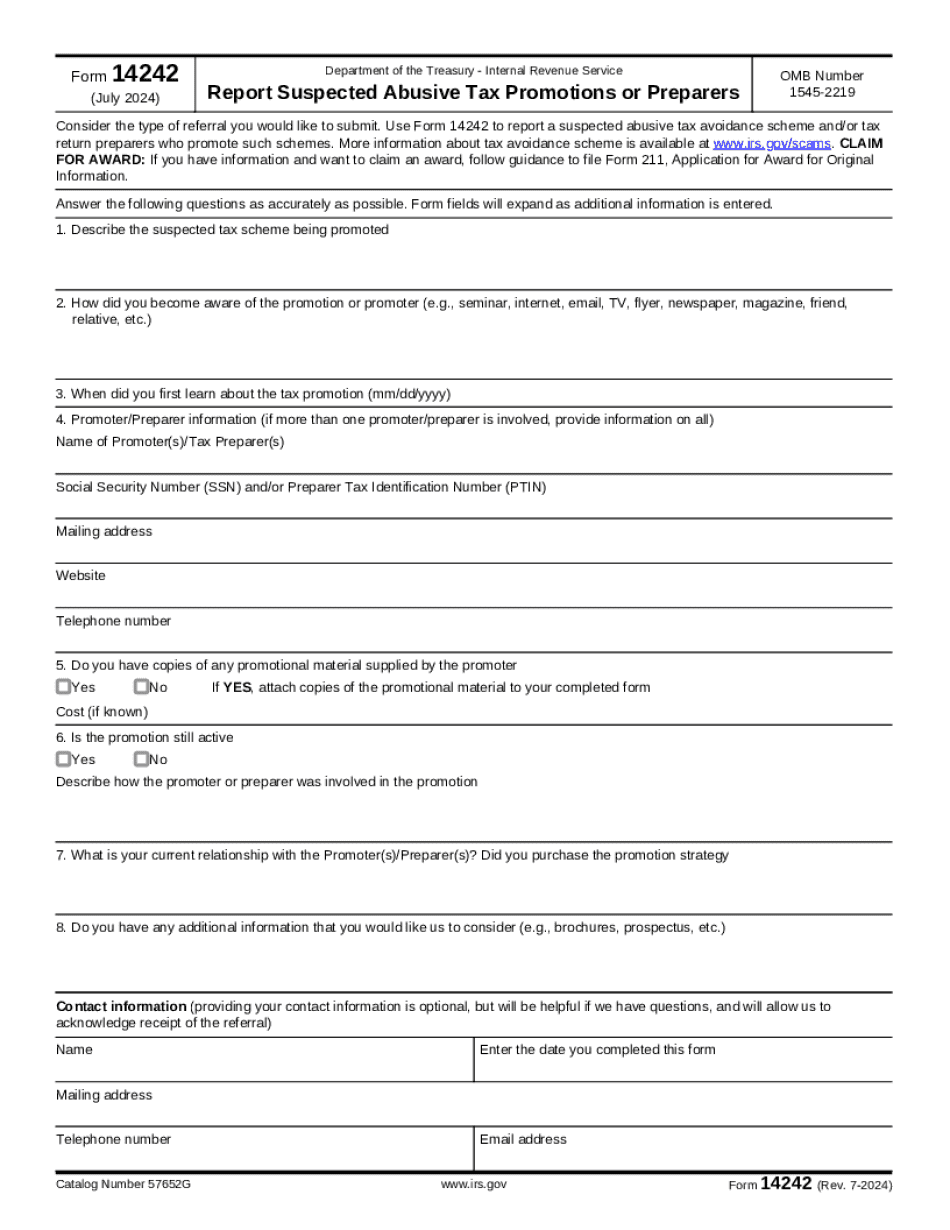

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.