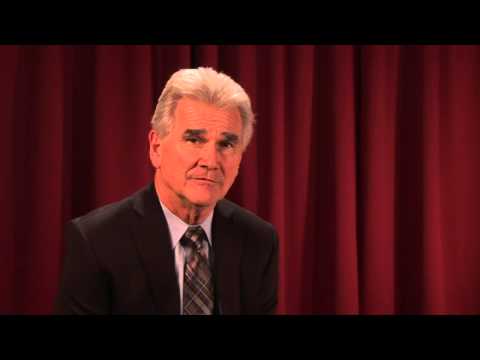

Hello, I'm Robert Todd. I'm here to address the question: what do I do if someone falsely declared me as a dependent for tax purposes? Well, obviously, if you did not grant them permission to do so, you need to report it. The agency to report it to is the Internal Revenue Service (IRS). You can go online to check if they have a mechanism available for you to report this false declaration of you as a dependent. Alternatively, you can find a telephone number to call and report this to an individual representative of the IRS. Another option is to consider going to your local office of the IRS and speaking with them about it. The important thing is that you want to report it and you want to do it as quickly as possible so that you don't get into any trouble. I'm Robert Todd, and that addresses the issue of someone falsely declaring you as a dependent for tax purposes. Thank you for watching.

Award-winning PDF software

3949-a 2025 Form: What You Should Know

Form 3949 A until you receive a Notice of Return Fraud (Form 4475). Use one of the following forms: Form 3853-T-1, Notice on Individual Filing Status Change. Form 2670, Notice of Audit or Notice of Return. Use this form to report suspected tax violations by an individual, a business, or both. Use Form 3949-K-1, Employer's Tax Return Information Return. If an individual reports tax fraud based on a Form 13969 or 13972, you should first contact that individual directly. If the taxpayer did not file a return, call the taxpayer's employer directly. If both of these do not work, contact the IRS via email at IRS.IR Sirs.gov. For individuals who were not involved in the tax return filing process, such as clients, shareholders, employers, vendors, or vendors' representatives, follow IRS Form 3949K-3. IRS Form 3949-K-1 Use this form to report suspected violation of income tax laws. Follow the instructions on reverse. Do not complete the form if it involves suspected tax law violations or fraud. Do not enter personal information. This form is for information and advice only. IRS does not initiate civil and criminal investigations. For more information, contact the Internal Revenue Service at (press 2) or by email at iris.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14242, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14242 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14242 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14242 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 3949-a 2025